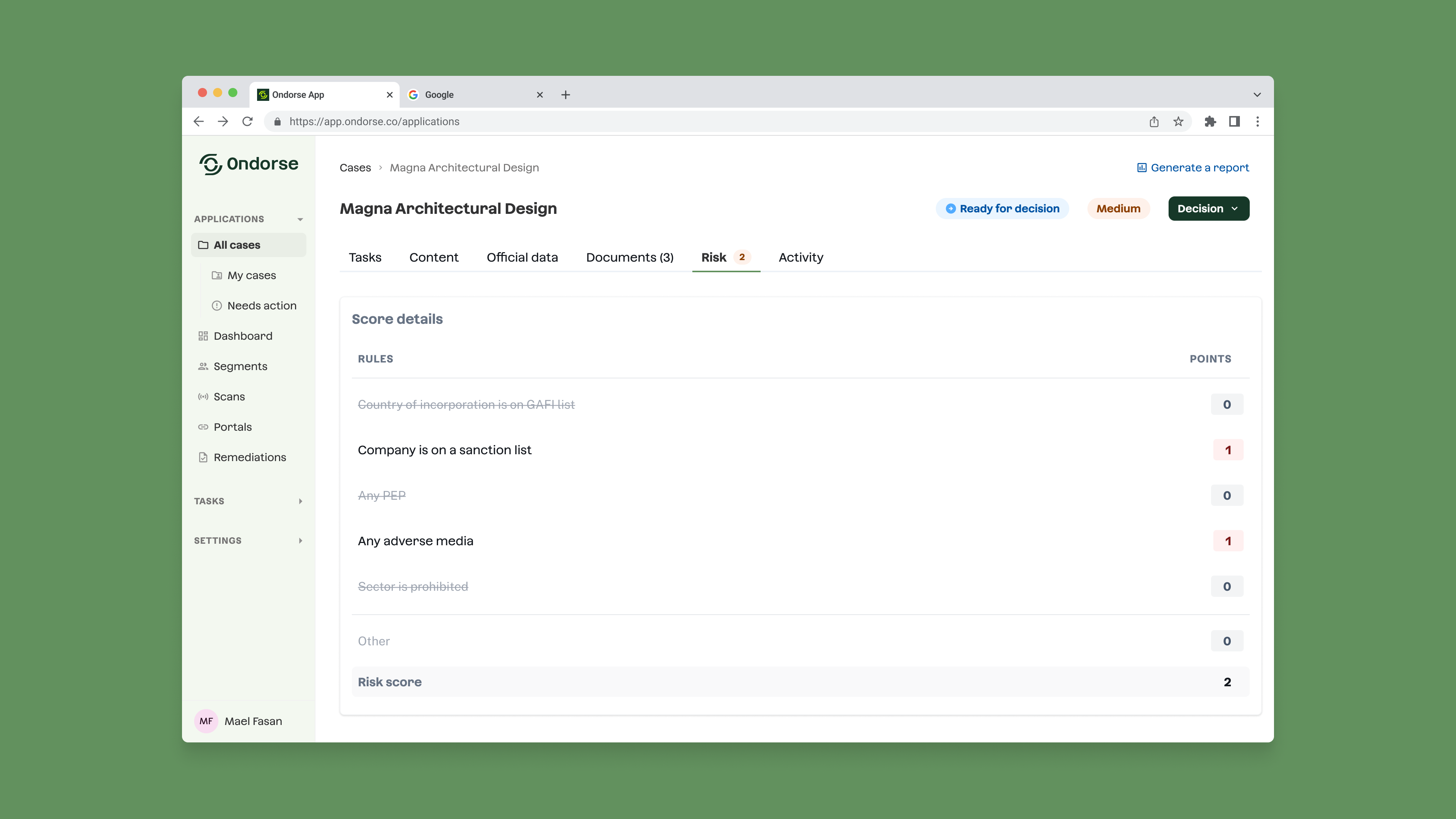

Risk scoring

Learn about risk scoring, risk levels, and how to build effective risk assessment rules with AI assistance and manual adjustments in your AML compliance workflow.

DefinitionRisk evaluation is a key component of an AML and risk policy. It provides a standardized measure of risk across all customers. Best practices include easy-to-understand risk rules, broad data input handling, and dynamic scores that refresh constantly.

Risk score

A risk score is a numerical value that represents how risky a case appears. Higher scores indicate greater risk, while lower scores suggest the entity is safer to deal with.

How risk scores work

Risk scores are calculated by evaluating cases against your risk matrix.

Risk MatrixA risk matrix is a collection of rules that assess different risk factors. Each rule has an associated weight (numerical value) that contributes to the overall risk score.

The calculation process works as follows:

- Each rule examines specific information within a case (risk factors)

- When a rule's conditions are met, its weight is added to the total score

- The final risk score is the sum of all triggered rule weights

Rules use a simplified coding language and can evaluate:

- Task results

- Default case data fields

- Custom fields

Example rule:

ifthen(any(application.persons, x => is_pep(x)), Add(1))Risk scores update continuously across all cases. This means any changes to underlying case data instantly reflect in the score.

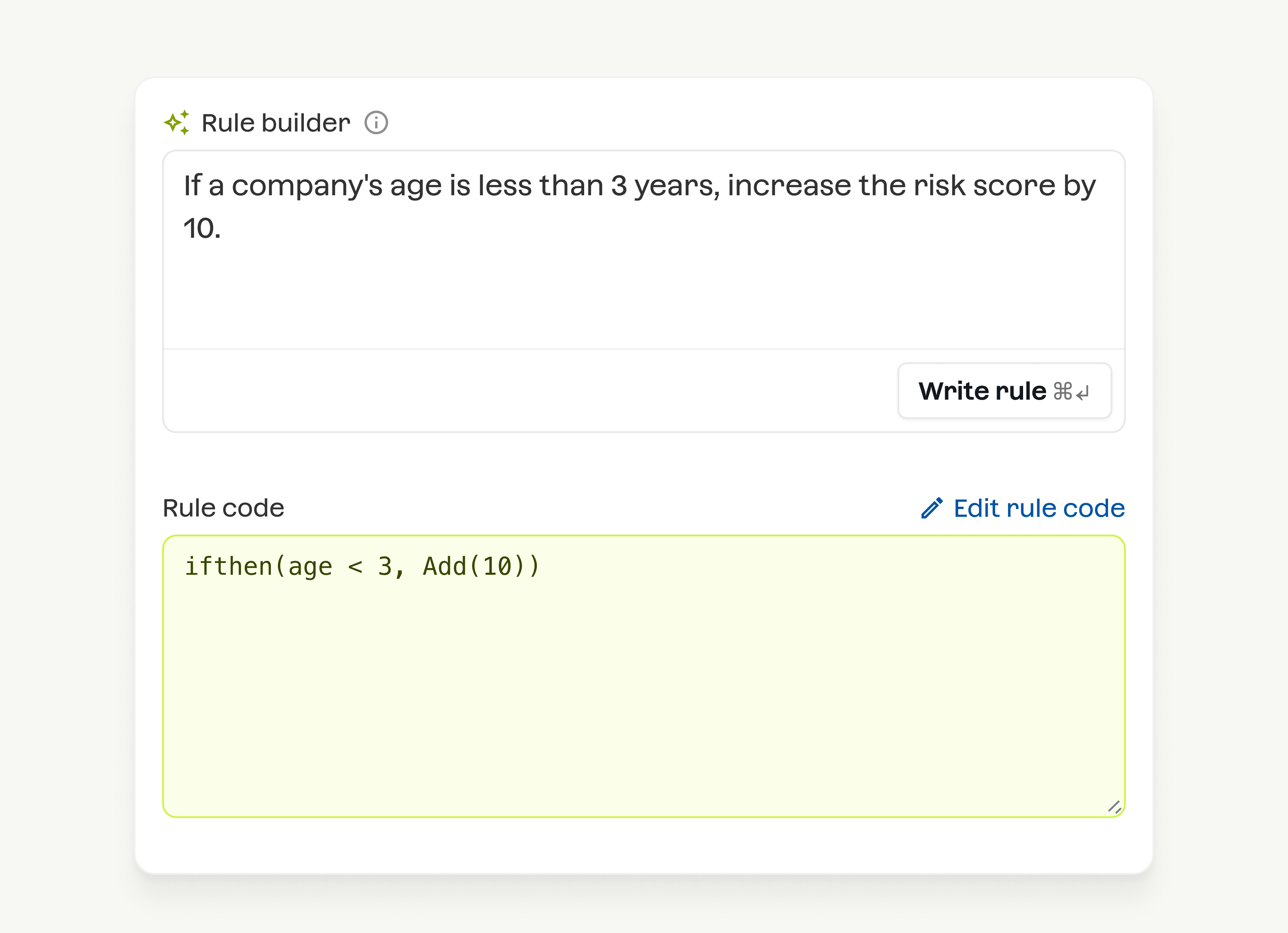

AI-assisted rule builder

Writing code can feel intimidating, even with simplified language. Our AI-assisted rule builder solves this problem.

Simply describe your rule in plain English, and the AI translates it into working code automatically.

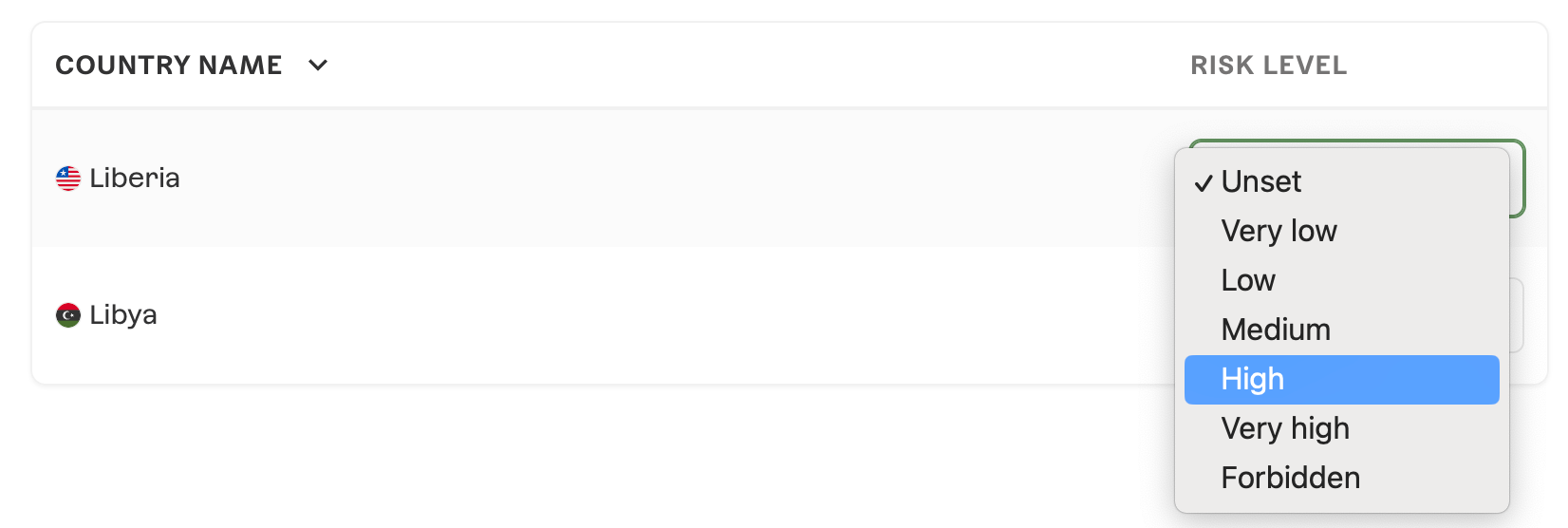

Risk mappings

Use risk mapping to customize your risk rules based on specific countries.

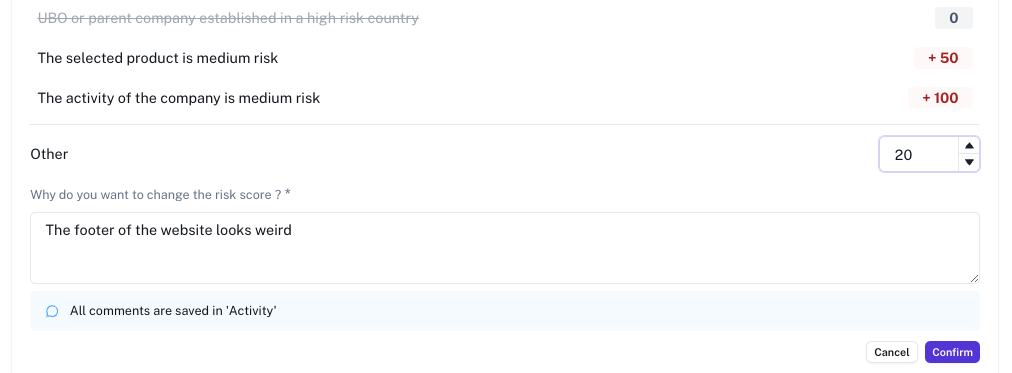

Manual adjustment

Sometimes risk assessment requires human judgment. The risk score can be manually adjusted with positive or negative increments to account for unpredictable factors.

Risk level

The risk level provides a simplified view of case risk using standard classifications:

- High risk

- Medium risk

- Low risk

While risk scores offer detailed precision, risk levels enable quick risk assessment. In Ondorse, risk levels help you:

- Drive decisions on cases

- Filter and identify the highest-risk cases

- Restrict approval rights to specific users

Setting risk levels automatically

Risk levels are determined automatically using your risk score matrix and other parameters available in the rules engine.

Rules EngineThe rules engine is a system that processes and evaluates conditions based on case data. It can consider risk scores, sanctions data, and other factors to determine appropriate risk levels.

A typical risk level configuration might look like:

- high risk: risk score >= 200 OR case has sanctioned directors

- medium risk: risk score >= 150 AND < 200

- low risk: risk score < 150Updated 3 months ago